In a bold move indicative of shifting priorities within the semiconductor industry, Intel Corporation has entered a significant agreement to divest 51% of its stake in Altera, a prominent player in programmable logic devices. This merger of their technological trajectories, which began before Intel’s full acquisition in 2015, is coming to a head as Intel seeks to bolster its core operations while handing the reins to an established investment firm, Silver Lake Partners. The deal, which notably values Altera at $8.75 billion — a stark contrast to the $16.7 billion Intel invested during the acquisition — raises questions about market valuation and strategic focus.

While some analysts may point to the stark reduction in Altera’s worth, it’s vital to recognize the prevailing trend in the tech landscape: companies are now prioritizing specialization amid fierce competition. Intel’s retention of a 49% stake reflects its desire to maintain a crucial influence over Altera’s future endeavors, illustrating a nuanced approach to divestment that retains a strategic partnership rather than a complete severance.

Navigating the Investment Terrain

Silver Lake, a titan in the investment arena, comes into this partnership with an impressive portfolio that extends beyond mere capital injection; it signifies an infusion of expertise and a fresh perspective. Notably, the firm has a history of impactful investments in high-growth technology ventures, suggesting that it’s not just money they’re placing on the table but a vision for transformation. Their involvement with renowned brands like Twitter and Airbnb further cements Silver Lake’s status as a heavy hitter in the investment community.

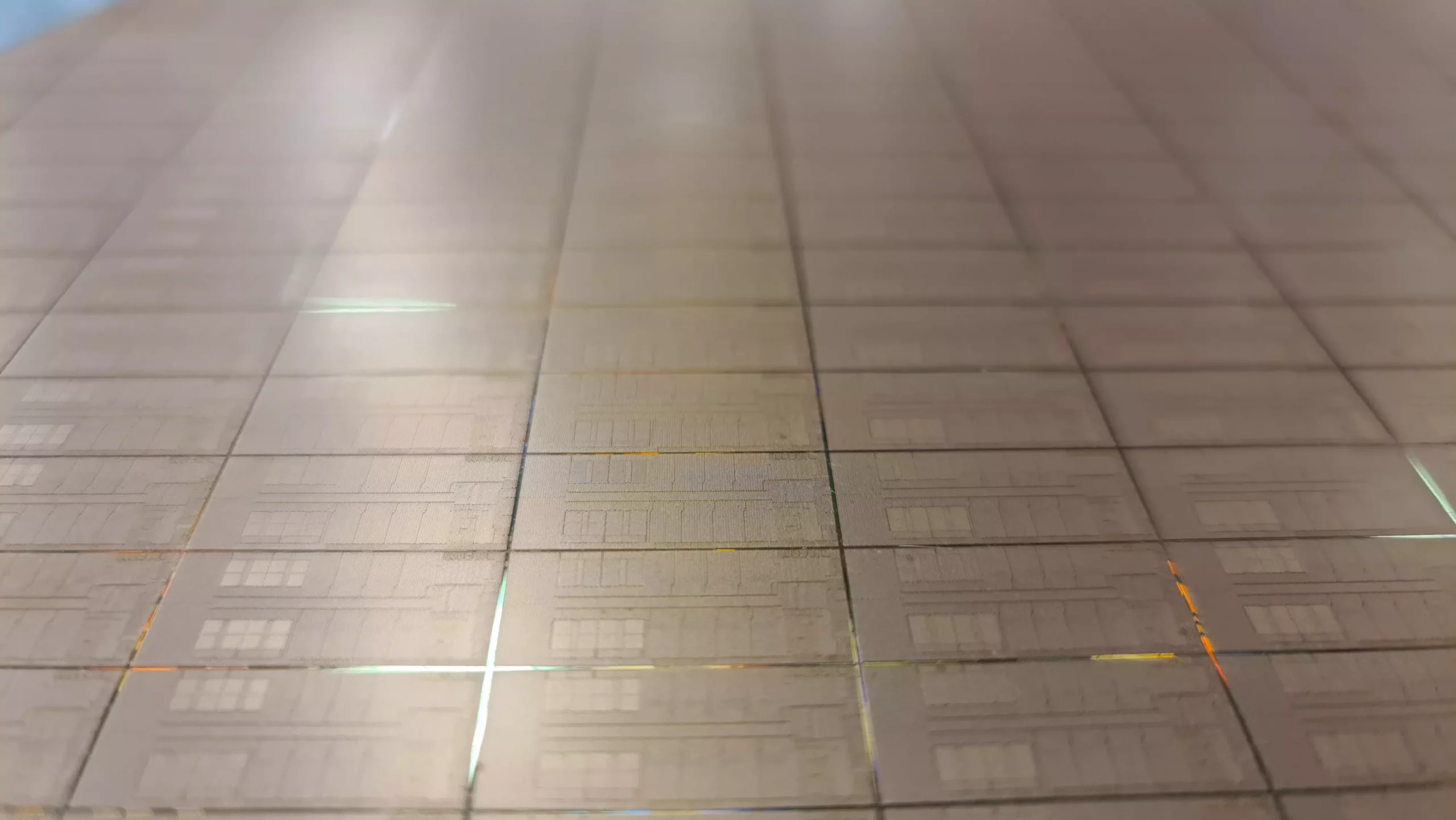

This deal marks a pivotal moment not just for Altera but for the broader semiconductor industry. With the continual rise of artificial intelligence, machine learning, and the internet of things, the demand for adaptable chip solutions is surging. Altera’s expertise in field-programmable gate arrays (FPGAs) positions it strategically within this bustling market, eager to harness new opportunities for growth.

Strategic Realignment for Intel

Intel’s motivations behind this sale are multifaceted. Primarily, the tech giant is clearly pivoting back towards its core business by streamlining focus and resources, amidst increasing competition from rivals like AMD and NVIDIA. With the semiconductor market evolving rapidly, Intel’s recalibration is a wise response to a changing landscape that demands flexibility and innovation in product offerings.

Moreover, the transition comes at a critical juncture as Raghib Hussain steps in as the new CEO of Altera, following Sandra Rivera’s tenure. This leadership change will likely infuse renewed strategic direction at Altera, potentially igniting innovative avenues that Silver Lake can exploit with its financial backing. The industry’s eyes will be keenly fixed on how Hussain navigates these waters, striving not just for independence but markedly enhanced performance.

The Road Ahead for Altera and Intel

As Altera embarks on its journey towards greater autonomy, the industry is presented with a unique case study in corporate strategy, investment, and technology evolution. How independent will Altera truly become, and how much influence will Intel wield with its remaining stake? While Altera may now be celebrated as the largest independent firm of its type, the specter of Intel’s historical involvement shadows its future directions.

The sale is emblematic of broader trends within technology investment — namely, a growing preference for specialized, agile firms capable of adapting to rapidly evolving market demands. Altera’s unique positioning in the programmable logic space means that it is poised to respond swiftly to chance, granting it a competitive advantage over less specialized competitors.

This transaction could very well set a precedent that other tech giants may follow; divestiture accompanied by strategic partnerships allows for a balance between innovation and accountability. With Silver Lake at the helm of a significant stake in Altera, the firm not only gains a foothold in a rapidly expanding market but also establishes itself as a cornerstone of the evolving landscape shaped by semiconductor innovation.

The juxtaposition of Intel’s legacy and Silver Lake’s astute investment strategy paints a hopeful future, characterized by an unprecedented collaboration that could very well define the next chapter of technological advancement. As the narrative unfolds, stakeholders and observers alike will watch with bated breath.